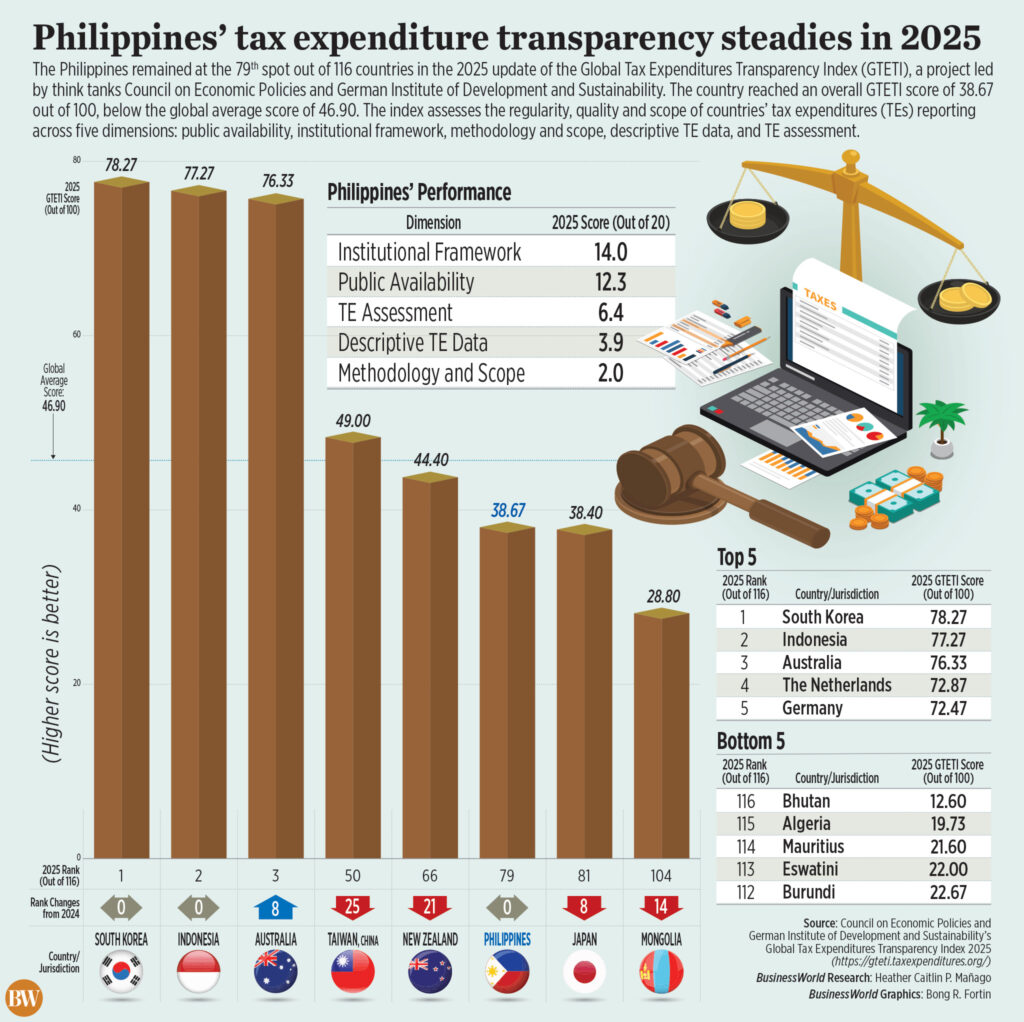

The Philippines continues to struggle with transparency in its tax system, holding steady at 79th place out of 116 nations in the latest Global Tax Expenditures Transparency Index. This ranking, revealed in the 2025 update, highlights a persistent challenge in making crucial financial information accessible to the public.

The nation’s overall score of 38.67 out of 100 falls significantly below the global average of 46.90. This gap underscores a critical need for improvement in how the Philippines manages and discloses information about tax expenditures – the benefits given to specific groups through the tax code.

The Index doesn’t simply look at *if* information is available, but *how* well it’s presented. It rigorously evaluates five key areas: how easily the public can access the data, the established institutional structures for reporting, the methods used to calculate tax expenditures, the breadth of taxes covered, and whether the impact of these expenditures is actually assessed.

Tax expenditures, while sometimes necessary, can represent substantial government revenue lost. Without clear transparency, it becomes difficult to determine if these benefits are truly serving the public interest or if they are disproportionately favoring certain entities.

A lack of detailed, publicly available information hinders informed debate and effective oversight of government finances. This ultimately impacts the ability of citizens and policymakers to make sound decisions about the nation’s economic future.

The Index serves as a vital benchmark, revealing areas where the Philippines can strengthen its commitment to fiscal accountability. Improving transparency in tax expenditures isn’t just about numbers; it’s about building trust and ensuring a fairer, more equitable system for everyone.